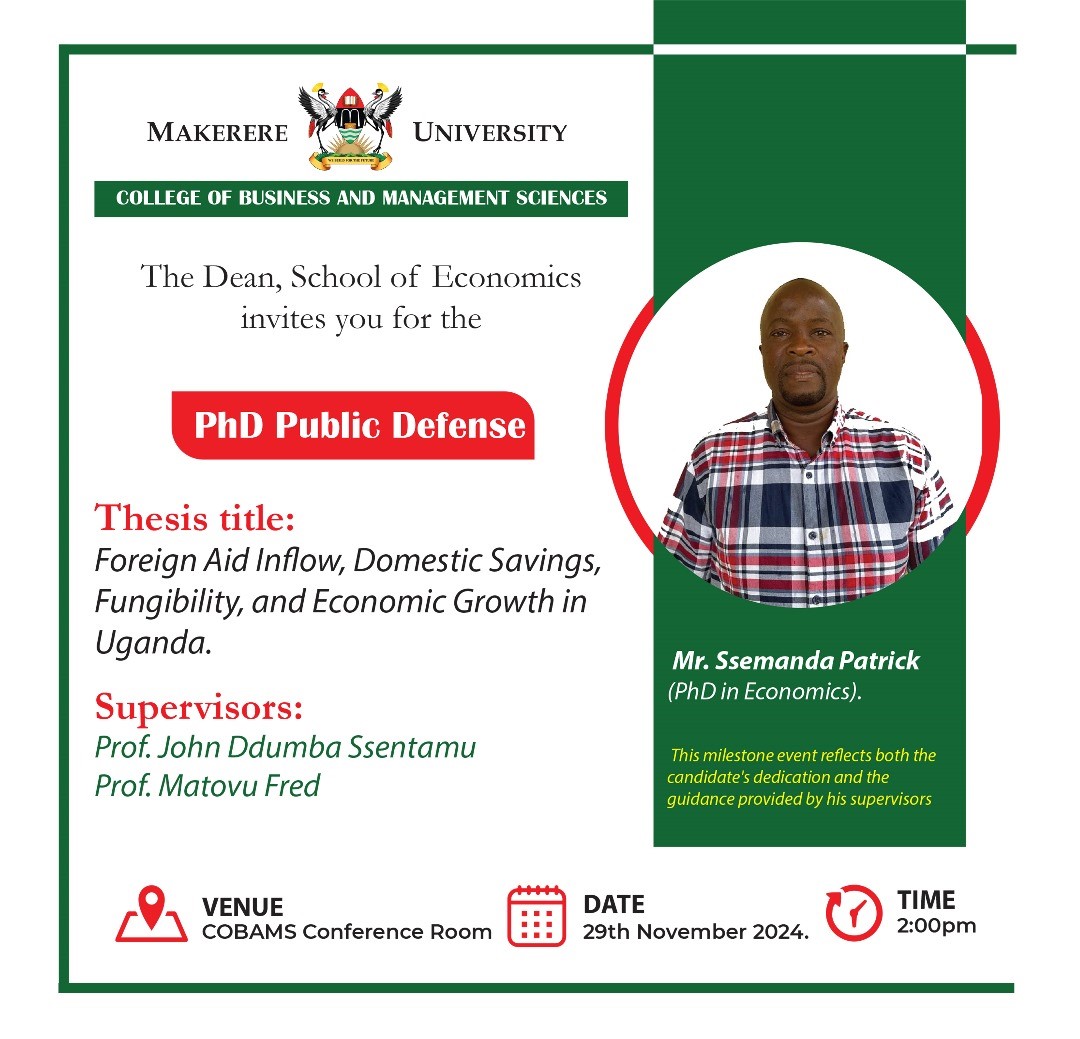

The Dean School of School of Economics invites you the PhD Public defense for Ssemanda Patrick (PhD in Economics).

ABSTRACT

Uganda set an ambitious economic growth target of 8.2% per annum in order to achieve middle income status by 2040. Domestic Savings target was set at 35% but it has stagnated at 16.7%, and revenue to GDP has remained below 12.5% compared to the target of 25%. These economic targets require very high economic growth to be achieved. Uganda has been receiving substantial foreign aid inflow, but its contribution to achieve these economic targets remain unclear. This study examines the effects of the increased foreign aid inflow on economic growth, gross domestic savings and assess whether fungibility occurred in Uganda. The empirical models are estimated using time series data for the period 1970- 2020 using the Autoregressive Distributed Lag (ARDL) approach to cointegration. Cointegration and error-correction modelling catered for the short run and the long-run effects, consistent with growth models. The three empirical chapters focused on; investigating the relationship between foreign aid inflow and economic growth, foreign aid inflow and domestic savings, foreign aid inflow and fungibility in Uganda between 1970 and 2020.

Results show that foreign aid inflow significantly reduced economic growth in Uganda in the short run and long run. The domestic investment had positive and significant effect on growth in the short run, while exports increased growth in the short and long run. The democracy index for previous periods, and effective labour had a negatively effect on output in the short run. In the long-run, however, effective Labour force, exports, and democratic index was found to increase output in the long run. An increase in foreign aid inflow leads to a drop in domestic savings and crowds out domestic savings in the long run. This is evidence suggests that foreign aid displaced gross domestic savings in the long-run but did not crowd out private investment in Uganda. Aid fungibility results showed that private investment was not crowded out. There was a reduction in tax revenue which could be attributed to weaknesses in the institution capacity and high poverty levels, low tax base and weaknesses in the fiscal regulatory framework in Uganda to ensure the efficiency of tax collection.

These findings suggest that Uganda should promote strategies to increase foreign direct investment (FDI) since it was found to be the most important in complementing domestic savings to generate growth in the longrun. Interruption in aid flows resulted in economic volatility, which in turn reduced investment and led to a slowdown in economic growth.

Supervisors:

Prof. John Ddumba Ssentamu and

Prof. Matovu Fred.